I want to tell you something that might surprise you about VA Loan rates today. Ready? Despite what you may have heard, securing a VA Loan with a competitive interest rate is absolutely possible in the current market. In fact, VA Loans consistently offer some of the most attractive mortgage rates available, making homeownership more accessible for our nation’s veterans and active-duty service members.

But here’s the thing: navigating the world of VA Loans and understanding how rates are determined can feel like a daunting task. That’s where I come in. I’m here to break down the complexities of VA Loan rates today and provide you with the knowledge and tools you need to make informed decisions about your mortgage.

Table of Contents:

- Current VA Loan Rates Today

- Factors That Affect VA Mortgage Rates

- Comparing VA Loans to Other Mortgage Options

- How to Qualify for a VA Loan

- The VA Loan Process

- Benefits of VA Loans

- VA Loan Refinancing Options

- Conclusion

Current VA Loan Rates Today

As a veteran who’s been through the VA loan process myself, I know how important it is to get the best va loan rates today. After all, even a small difference in your va loan rate can save you thousands over the life of your va loans.

Wondering what the latest VA loan rates are? Let’s break it down for you.

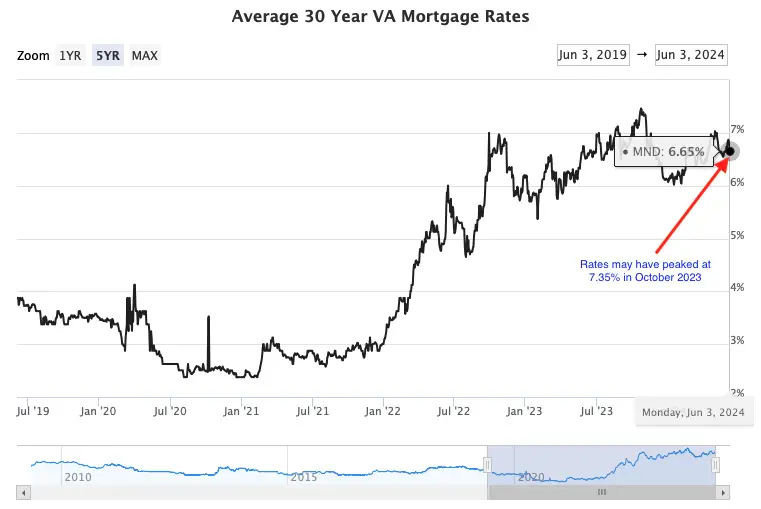

Average 30-Year VA Loan Rate

The 30-year fixed va mortgage rates are the most popular choice among veterans. As of June 2024, the average va rate for a 30-year fixed mortgage loan is around 6.65%.

That’s slightly lower than conventional 30-year rates on 6/3/2024, which average 7.11%. Even a quarter of a percent can make a big difference in your mortgage payments and total interest paid over the life of the loan.

15-Year VA Loan Rates

If you’re looking to pay off your loan faster and save on interest, a 15-year VA loan rates might be the way to go. Currently, the average rate for a 15-year fixed VA loan varies from lender to lender. You can see that the average 15-year fixed rate mortgage average in the US (which is not specific to a fixed 15-year VA Loan) is 6.36% as of May 30, 2024 according to FRED data.

Keep in mind, your monthly payments will be higher with a 15-year loan compared to a 30-year VA Loan. But you’ll save a significant amount on interest and own your home outright in half the time. Talk with a financial advisor if you’re on the fence between a 15-year loan and a 30-year VA Loan. Some people like locking in a lower rate and being forced to pay off their home faster. Others like the flexibility of a 30-year VA backed mortgage and simply paying it off faster.

5/1 ARM VA Loan Rates

Adjustable-rate mortgages, or ARMs, are another option for VA borrowers. With a 5/1 ARM, your interest rate is fixed for the first 5 years, then can adjust annually after that.

As of now, the average initial rate for a 5/1 ARM is around 6.64% according to the Mortgage Bankers Association weekly survey. That’s lower than the 30-year fixed rate VA Loan, but keep in mind, your rate could go up (or down) after that initial 5-year period, affecting your mortgage payment.

Factors That Affect VA Mortgage Rates

Now that you know the current va mortgage rates, let’s talk about what factors actually impact your individual rate. Because not everyone gets that average rate – your unique financial situation plays a big role.

Credit Score Impact on VA Rates

While the VA doesn’t have a minimum credit score requirement, most mortgage lenders want to see a score of at least 620. And in general, the higher your score, the better your rate.

I always recommend pulling your credit report before applying for a VA loan. That way, you can catch any errors and get an idea of where you stand. Even boosting your score by a few points can sometimes get you a lower rate, saving you money on your monthly mortgage payments.

Annual Percentage Rate (APR) Explained

When comparing VA loan offers, it’s important to look at both the interest rate and the annual percentage rate (APR). The APR includes the interest rate plus other costs like the VA funding fee and lender fees.

So while the interest rate is important, the APR gives you a more complete picture of your total borrowing costs. Don’t get tunnel vision on the interest rate alone when going through the mortgage loan process.

Discount Points and VA Loans

Discount points are an optional fee you can pay upfront to lower your interest rate. Typically, one point costs 1% of your loan amount and lowers your rate by 0.25%.

Whether discount points are worth it depends on your situation. If you plan to stay in the home a long time, the long-term savings from a lower rate could outweigh the upfront cost. But if you think you might move or refinance in a few years, it might not be worth it.

VA Funding Fee Considerations

If you’re considering a VA home loan, you’ll need to pay a one-time VA funding fee. The cost ranges between 1.4% and 3.6% of your total loan amount based on several factors such as your down payment size, previous use of VA Loans, and military status including Reserves or National Guard membership.

Some borrowers, like those with service-connected disabilities, are exempt from paying the funding fee. And for those who do pay it, you can often roll it into your loan amount rather than paying out of pocket, but this will increase your mortgage payments.

Loan Origination Fees

Lenders can charge an origination fee to cover their administrative costs. For VA loans, this fee is capped at 1% of the loan amount.

When comparing lenders, look at their origination fees. Some might charge the full 1%, while others might have lower or no origination fees. This can make a difference in your upfront closing costs.

Comparing VA Loans to Other Mortgage Options

If you’ve served in the military, VA Loans are a great perk. But don’t forget, they’re just one of many mortgage choices available. Let’s explore how they hold up against other common loan options.

VA Loans vs. Conventional Loans

Conventional loans are the most common type of mortgage. They’re not backed by the government like VA loans are. And they usually require a down payment of at least 3%, plus private mortgage insurance (PMI) if you put down less than 20%.

VA loans, on the other hand, require no down payment or PMI. They also tend to have lower average interest rates than conventional loans. However, conventional loans can be used for vacation homes and investment properties, while VA loans are for primary residences only.

Advantages of VA Loans

One of the biggest perks of VA Loans is that you don’t need a down payment, and there’s no PMI to worry about. This makes it much easier for first-time buyers to afford their own homes.

VA loans also tend to have more lenient credit score and debt-to-income requirements compared to conventional loans. And the VA funding fee can be waived for some borrowers, like those with service-connected disabilities.

USDA Loans as an Alternative

USDA loans are another $0 down mortgage option. They’re backed by the U.S. Department of Agriculture and are for homes in designated rural areas. Like VA Loans, they have lower credit score requirements than conventional loans.

However, USDA loans have income limits and are only for those who meet certain criteria, like being a first-time homebuyer. VA Loans don’t have these restrictions.

Refinancing with a VA Loan

If you already have a VA loan, you may be able to lower your rate or payment by refinancing with an Interest Rate Reduction Refinance Loan (IRRRL), also known as a VA Streamline Refinance.

Or, if you have a non-VA loan, you could refinance into a VA loan to get rid of PMI or tap into your equity with a VA Cash-Out Refinance. The point is, VA refinance loans give you options down the road.

How to Qualify for a VA Loan

Wondering if a VA Loan is the right choice for you? Let’s break down who qualifies and how to kickstart your application process.

Service Member Eligibility

Most service members are eligible for a VA Loan after 90 days of active duty during wartime or 181 days during peacetime. Reservists and National Guard members are typically eligible after 6 years of service.

If you’re a surviving spouse of a service member who died in the line of duty or from a service-connected disability, you may also be eligible for VA Loan benefits.

Surviving Spouse Eligibility

The VA wants to take care of military families, including surviving spouses. If you’re the surviving spouse of a veteran who died in service or from a service-connected disability, you could be eligible for a VA loan.

There are a few other criteria, like not remarrying before age 57. But in general, the VA wants to make sure those who have sacrificed for our country are taken care of.

Finding a VA-Approved Lender

Once you’ve determined your eligibility, it’s time to find a va lender. Not all lenders offer VA loans, so you’ll want to shop around for one that does and has experience with the VA mortgage loan process.

Your first step could be reaching out to both banks and local federal credit unions.

VA Funding Fee Exemptions

The VA funding fee helps keep the VA loan program running for future generations of service members. However, some people are exempt from paying it.

If you receive VA disability compensation or have a service-connected disability rating of 10% or higher, you’re exempt from the VA funding fee. Purple Heart recipients serving in an active duty capacity are also exempt.

Key Takeaway:

Understanding VA loan rates is crucial for veterans. Current average rates are 6.25% for a 30-year, 5.75% for a 15-year, and around 5.5% for a 5/1 ARM VA loan.

Your credit score plays a big role in the rate you get, so check it before applying.

The VA Loan Process

Getting a VA loan isn’t as complicated as you might think. In fact, the process is pretty straightforward once you know what to expect. Here’s a quick rundown of the steps involved in getting a VA loan:

Getting Preapproved for a VA Loan

The first step is to get preapproved for a VA loan. This involves providing your lender with some basic information about your income, debts, and assets. Your lender will then pull your credit report and review your financial situation to determine how much you can afford to borrow.

If you get preapproved, you’ll know exactly what price range to look at for homes. This not only makes searching easier but also proves to sellers that you’re ready to buy—a big help when competition is fierce.

Submitting Your VA Loan Application

So, you’ve picked out the house you want. Now comes the exciting part—sending in your VA loan application.

Your lender will need several documents from you, like your Certificate of Eligibility (COE), proof of income, and bank statements. Make sure to get these to them quickly so the mortgage loan process doesn’t hit any delays.

Working with a Loan Officer

As you work through the VA loan process, a dedicated loan officer will be there to help. This person will guide you step-by-step and make sure everything stays on track.

I’ve had the pleasure of working with some fantastic loan officers over the years. A good one can really make a difference by helping you through all that paperwork, breaking down your loan options, and keeping you updated at every turn.

Exploring VA Loan Options

VA loans come with a variety of options that can suit almost any situation. Whether you’re purchasing your first home, refinancing an existing mortgage, or aiming to make some energy-efficient improvements, there’s likely a VA loan available for you.

Your loan officer can guide you through your mortgage choices and help find the best fit. With VA mortgage rates still hovering near historic lows, now is a fantastic time to take advantage of this benefit.

Benefits of VA Loans

If you’re a veteran or active-duty service member, a VA loan is hands-down one of the best ways to finance a home. Here are just a few of the benefits:

No Private Mortgage Insurance (PMI)

With a conventional loan, you’ll typically have to pay for private mortgage insurance (PMI) if you put less than 20% down. But with a VA loan, there’s no PMI requirement, even if you put zero down payment.

Imagine saving hundreds of dollars each month and tens of thousands over the lifetime of your loan. This incredible benefit makes homeownership much more affordable for veterans and service members.

Lower Monthly Mortgage Payments

VA loans often have lower monthly mortgage payments than other types of loans. This is mainly because VA loans usually come with lower interest rates and don’t require PMI, helping you save quite a bit each month.

With the incredibly low current VA mortgage rates, it’s smart to lock in a lower monthly payment while you can.

Reduced Closing Costs

Another big benefit of VA loans is that they limit the closing costs lenders can charge. Things like loan origination fees, underwriting fees, and processing fees are capped, which can save you money upfront.

And in some cases, the seller may even agree to pay some or all of your closing costs as part of the deal. It never hurts to ask.

VA Funding Fee Flexibility

When you take out a VA loan, there’s something called the VA funding fee. It’s a one-time charge that ensures this valuable benefit remains accessible to other veterans down the line.

The VA funding fee can be rolled into your loan amount, so you don’t have to pay it out of pocket. And if you receive VA disability compensation, you may be exempt from paying the fee altogether.

Zero Down Payment Option

Perhaps the most well-known benefit of VA loans is the ability to buy a home with zero down payment. That’s right – you can finance 100% of the purchase price, which makes homeownership accessible for many veterans who might not otherwise be able to afford it.

Of course, putting some money down can still be a smart move if you’re able. It can lower your monthly payments and give you instant equity in your home. But it’s nice to know that the zero down payment option is there if you need it.

VA Loan Refinancing Options

If you already have a VA loan, you may be able to refinance to a lower interest rate or get cash out of your home’s equity. Here are a couple of options to consider:

Interest Rate Reduction Refinance Loan (IRRRL)

An Interest Rate Reduction Refinance Loan (IRRRL), also known as a VA Streamline Refinance, allows you to refinance your existing VA loan to a lower interest rate with minimal paperwork and no appraisal required.

If va refinance rates are lower than when you first got your loan, an IRRRL could help you lock in a lower monthly payment and save money over the life of your loan.

Cash-Out Refinance

A VA Cash-Out Refinance allows you to refinance your existing VA loan and take cash out of your home’s equity at the same time. You can use the money for anything you want, like paying off high-interest debt, making home improvements, or funding a child’s education.

Keep in mind that a Cash-Out Refinance will typically have a higher interest rate than an IRRRL, and you’ll need to go through the full underwriting process again. But it can be a smart way to access your home’s equity if you need it.

Refinancing to a Conventional Loan

In some cases, it may make sense to refinance your VA loan to a conventional loan. For example, if you have enough equity in your home and want to eliminate the VA funding fee, a conventional refinance loan could be a good option.

Just keep in mind that you’ll likely need a higher credit score and more equity to qualify for a conventional loan, and you may have to pay for private mortgage insurance if you put less than 20% down.

When looking to refinance, make sure you check out the current VA mortgage rates from several lenders. Doing a bit of homework can help you score the best deal and save big over time.

Key Takeaway:

Getting a VA loan is straightforward once you know the steps. Start by getting preapproved to understand your budget and show sellers you’re serious. Submit your application with required documents, work closely with a loan officer, and explore various mortgage options that fit your needs.

Conclusion

So, what have we learned about va loan rates today? We’ve seen that VA loans offer competitive interest rates, making homeownership more attainable for veterans and active-duty service members. We’ve also explored the factors that influence VA loan rates, from credit scores to market conditions.

Knowing about VA loan rates sets you up for success, but it’s not where things end. You need to take charge of your finances and choose wisely based on what fits best with your own plans and needs. If this is your initial venture into homebuying or if you’re thinking about refinancing, remember—you’ve got control over these decisions.

As a veteran or service member, you’ve earned these benefits. Don’t let the current VA loan rates intimidate you from owning your dream home. Embrace this chance and step into a brighter financial future.